With the prominence of cryptocurrency in mainstream media and trading influencers on social media platforms, trading appetite has risen dramatically in recent years. Online brokers have also massively reduced barriers to entry for the retail market through the introduction of micro-lots, spread betting platforms, and reduced commissions, amongst other factors. All of this means the financial markets are more accessible than ever to would-be traders, all without a huge amount of initial investment.

Yet, creating realistic expectations for our trading journey is necessary to become a successful trader. Many trading influencers make it seem easy and promote a lavish lifestyle full of private jets and luxurious holidays.

The fact of the matter is, when starting out in any profession, we lack the necessary skills to perform at a high level. As a retail trader, you are up against career professionals and sophisticated technologies when you enter the financial markets. This is not to say anyone needs to be a mathematical genius, which is a misconception many have, and it is not to say we cannot profit from the markets. However, it means we have to educate ourselves properly to put ourselves in the best position possible to create that long-term success we desire.

This lack of quality education, and the creation of unrealistic expectations, are, in my opinion, some of the main reasons that 90% of retail traders fail to make money in the markets. Most courses and retail traders tend to be strategy focussed. When the fact of the matter is, no matter what position you are starting from and what you ultimately wish to achieve from trading, without an understanding of the risks involved and how to manage them, you cannot create that long-term success we desire.

Read on for my tips to learning and starting with trading, the right way.

20-25% of the US stock market volume is traded by retail traders

Understand the goals you want to achieve

Individuals are unique, which means the amount of time someone may want to commit to trading and what they want to achieve will vary greatly. Some will wish to earn a supplementary income, alongside their full-time job to pay for a few extra luxuries. Others will want to learn a new skill and supplement their pensions in retirement. Many I have come across wish to take a more active role in creating a long-term strategy to help build a nest egg for when they retire. A few may even wish to take trading on to replace their income and make it their full-time profession.

Whatever your position, this does not limit your ability to profit from the markets, as long as you manage your expectations and approach trading in the responsible way necessary to achieve long-term success.

Each scenario will require a different level of commitment and education to achieve a different desired outcome. The main thing is to determine what you want to achieve from trading, the available resources, the necessary education, and create the roadmap to achieve your ultimate goals.

Find a style that suits your goals

Once you have decided upon your goals, you then need to work out the style of trading that will be best suited to achieving those goals and which will align with your trader personality. A scalper will trade many times a day, looking for small moves in the market. A day-trader trades just a few times a day, whereas a swing trader may only trade a few times a month as they look to hold positions over a longer period. There is no right or wrong. It is about working out what is best suited for you as you begin your journey.

Figure out what financial assets you want to trade

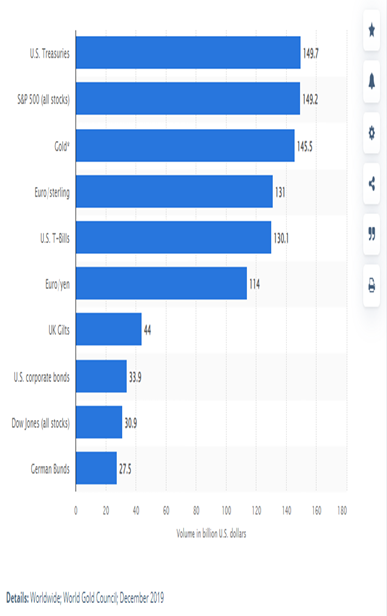

There are many different assets and instruments available for retail traders to participate in. Stocks, foreign exchange – FX, indices, commodities, bonds, options, derivatives, and of course, cryptocurrency are just a few of your options.

When starting out you should be looking to trade some of the most liquid assets available – those that are easy and quick to buy and sell. For example, Foreign Exchange worth around $6.6 trillion is traded every single day! Roughly 25% of this daily volume is traded on the Euro vs US Dollar, making it the most liquid instrument tradeable.

$6.6 Trillion in value is traded daily on the FX markets alone

See below for some of the other most tradeable assets available and their daily volumes

Select a broker that fits your strategy

There are many options when it comes to choosing a broker. Spread betting platforms have obvious tax advantages for UK-based retail traders, but many CFD platforms will have tighter spreads – the difference in price between the buy and sell price – and reduced commissions. Suppose you are starting out with very modest capital. In that case, you will probably need to consider a broker that offers micro-lots, which represent small units to trade with. But whichever broker you decide to use, it is imperative you do your research and make sure the firm is FCA regulated. It would also be important, in my opinion, to make sure they offer the option of a demo account – where you can practice and hone your skills in a safe environment.

Train your mind to avoid emotionally-driven mistakes

Emotions will also play a significant part in a trader’s career, and this is one area that is often ignored and not addressed appropriately. Experiencing loss is a natural part of a trader’s life, and this unsurprisingly evokes an emotional response. In fact, anxiety, fear, greed, and joy are just some of the other natural emotional responses that traders will also experience regularly. Without the proper training on how to mitigate the impact of these, critical decisions may end up emotionally driven rather than rationally so, to the detriment of our trading results. It is not about fighting these emotions – more about learning how to prevent them from dictating our decision-making process.

Find good quality education and train yourself properly

When choosing your education provider, it is important to do some due diligence to ensure they can provide an education suited to the path you wish to take. There is no point in enrolling in a day-trading stock course if you wish to become a swing trader. You want to make sure the course will provide you with all the tools you need to be successful. It must give you an understanding of the risks involved and knowledge of managing these risks.

If you choose a mentoring programme, you need to make sure the mentor provides you with the real support you need. A good relationship with your mentor is a must. They will need to understand what you wish to achieve from trading, so it is important to have an in-depth chat before determining exactly what they are offering and what they will require from you.

One thing is for sure – trading will require patience and dedication. It is a set of skills you need to develop responsibly, even if only to achieve an understanding of the risks involved. As with any industry and profession, these skills will take some time to build to position you to perform at a required level to be successful.

About the Author

Ross Maxwell is a professional trader, trading educator, and founder of Key Zone Traders. Ross has more than 15 years of experience, trading in the City of London and Hong Kong as a regulated individual and as a full-time professional trader. With a track record of coaching and mentoring aspiring traders across the globe to achieve their trading goals.

Start your free trading course today